First, you must know . . second, I must convince myself . . I am not laughing about this budget. It is very serious to Vince. It means a lot to him that I go along with it. I am going along with it. Like I’ve mentioned before, I’ve lived on a budget at various times. When I was pinching pennies til they screamed and I cried, I knew that I had “X” amount of money and I had no choice but to live on that amount. I can remember when Chad was 6 or 7 and I was a single mom and there was not an extra dime to be had. I could make one can of green beans last three meals for myself but manage to give him a decent kid sized meal. Those days are long gone but will never be forgotten. So, honestly, I appreciate a budget. I don’t fully understand the reasoning behind this budget. But, to make him happy, I am going right along with this budget idea. Anyway . . if I weren’t doing it, what would I be blogging about?

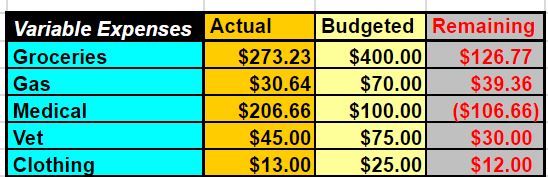

OK . . here’s a portion of the budget.

Today is the 11th so let’s say we’re 1/3 into the month. Also, there’s supposed to be a category for “Household Supplies” and that’s where I’ll put washing detergent, ziploc bags, paper towels, etc. Vince forgot that category so a bit over $110 that was spent at Sam’s will be credited back to groceries and will go against a $175 monthly allowance for household supplies.

If I add back the $110 to groceries, that gives me $235 remaining which is a bit less than 2/3rds but I did buy two hams at Aldi and with the ribs I smoked, we have leftovers already cooked in the fridge to get us through the middle of next week and we just don’t need anything from the grocery store for sure for the next week, except possibly a gallon of milk. So, we’re great on groceries.

We’re good on gas. I probably won’t fill my car up again til after the first of February.

Medical took a hit because I went to the dentist. That appointment wasn’t scheduled til the end of February but the dentist had an opening. I don’t go back to the knee doctor til April so even though we’re way over for January, I think by the end of March, we’ll be fine.

Vet . . we’re going to have a credit on that one because Rita is done at the vet for this month.

Clothing . . this one cracked me up. What the heck are you going to buy for $25? I suggested nothing for clothing but Vince insisted on $25. Heck, Vince ordered sweatpants and I think he got two pairs for $13 so that gives me hope . . or not! $12 left for this month. Sure hope we don’t new clothes.

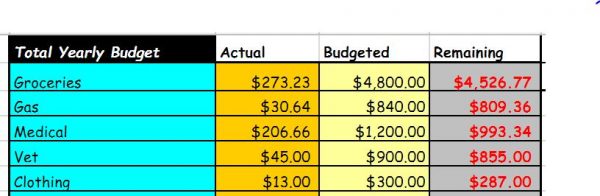

I can project out to the year for those who suggested an annual budget.

We have categories for chicken feed, pet food and vet and those alone total almost $2,500 per year. That’s a lot . . considered it’s half of what we allow ourselves for groceries. Our critters are worth it though . . I suppose.

I’m looking forward to the end of the month to see how we do.

Maggie says

I definitely think there is merit in looking at your expenses, because that is for sure a big component of retirement planning. MY financial advisor just sent me a worksheet to use because he was unimpressed with my spreadsheet I made myself (I don’t blame him, I didn’t even put food on it!) If you were to just look at your spending without trying to live within a tight budget, the answer might turn out to be that Vince will need to work forever!

Laura says

I had the same reaction as you when I saw the budget for clothing: “What the heck are you going to buy for $25?” But if all Vince needs is sweatpants and T-shirts in retirement (and you already said you don’t need anything), I guess it’s possible!

Inka says

If you knit your clothing yourself is this budget for yarn?

Helene says

I agree. Sock yarn should definitely go into the clothing category. But it needs to be a bit more.

April Reeves says

Hold up Judy! Where is the Not Budgeted line where spending accumulates in the actual column while budgeted column stays at zero. That is the line that gets me in trouble. But be sure to keep a separate line for you and for Vince. lol.

I’m a single mom with 2 boys, 8 and 10. I’m in the I only have so much money to get me thru to paycheck day after covering bills and expenses and thus spending can’t really get out of control. But if I want out of my apartment and into a house, I need to tighten the belt even further. So I am also tracking more and watching what I spend this year. So it is fun following your budget adventures. If Judy can do it, so can I.

Ranch Wife says

At this point in our lives, I look at a budget as almost a game. It’s kind of fun when you start, but it’s not long before I’m ready to pack it back up and stash it in the closet. Honestly, though, we need to get more serious about putting away for retirement. No retirement or pension plans when you work on a ranch.

Honestly, though, we need to get more serious about putting away for retirement. No retirement or pension plans when you work on a ranch.

They say you ought to start saving when you’re 20, but who thinks they’re ever going to get old when they’re 20? No-one! Then you blink twice and your’re 50!

Emma says

For the $25 of clothing, could maybe you carry over any unused amount to the next month? So at the end of the year if your total spent on clothes is less than $300 then you’re golden, even if some months you spent $50 or more?

Susan says

That all seems very logical. A debit one month can be taken up by a credit another month, as long as there’s a cushion in the bank, and it sounds like you are making good progress! I don’t have the vet or chicken feed in my budget. =) But Aldi? Yep, that’s in the budget!